UBS AM | Escalating US-China tensions because the November election nears are prone to foster volatility, with measures taken towards Chinese language expertise a focus.

The drumbeat of US-China tensions is prone to crescendo within the coming months, with the connection devolving throughout geopolitical, diplomatic and financial fronts. From a market perspective, Chinese language expertise shares might face important volatility given escalating conflicts between the 2 sides. In the meantime, typical knowledge holds that the dominant market place and earnings energy of US expertise heavyweights are unassailable.

Nonetheless, traders shouldn’t lose sight of the massive image. We imagine that any disruption over coming months might present pockets of alternative in Chinese language expertise shares, which take pleasure in supportive underlying traits that embrace a deep, captive home base and a authorities dedicated to the event of expertise champions as effectively as macroeconomic stability.

In our opinion, there are two overarching questions that traders should hold on the forefront of their minds in assessing the diploma and nature of their most well-liked publicity to expertise:

- What’s the potential for a disruptive acceleration in US-China tech decoupling as the connection between the 2 international locations deteriorates?

- How a lot will world in addition to home tax and regulatory shifts threaten to undermine the dominant place of US tech corporations?

We imagine that US-China tech decoupling is a longer-term story, and the prospect of an abrupt fracturing on this relationship doesn’t seem imminent. And in a world wherein COVID-19 has exacerbated and laid naked the hardships of victims of financial inequality, politicians within the US and overseas could also be incentivized to rein within the monetary advantages accruing to the extra worthwhile and monopolistic entities, the US tech giants.

Nonetheless, a level of portfolio safety can be prudent in gentle of the rising rifts between the world’s two largest economies within the coming months. As such, we stay lengthy the US greenback relative to cyclical Asian currencies, just like the Taiwanese greenback and Korean received, which might possible come beneath acute stress ought to tensions between the 2 sides – commerce or in any other case – flare up.

Chilly tech battle, not sizzling

There may be bipartisan assist within the US for utilizing all means needed – laws, government orders and gentle energy – to restrict China’s ascension in world expertise and allay nationwide safety issues surrounding the potential deployment of Chinese language communications expertise within the US and different components of the developed world.

However probably the most at-risk segments of the Chinese language market appear priced to mirror a few of these draw back dangers, whereas proof from the commerce dispute implies a full clampdown on the Chinese language expertise sector isn’t in the most effective curiosity of the US.

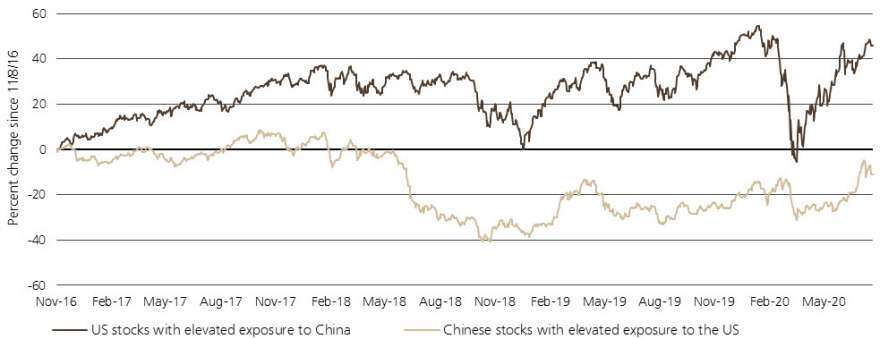

Chinese language shares nonetheless bear scars from the commerce battle that preceded the Part 1 settlement signed in early 2020, judging by the hole in returns between Chinese language shares with heavy publicity to the US and American corporations that generate a considerable share of revenues from the world’s second-largest financial system because the 2016 US election. All the relative underperformance of broad proxies for Chinese language tech vs. their US friends occurred throughout a six-month span in 2018 when the commerce battle started.

A détente on commerce was reached earlier than the US imposed tariffs on imports of common client items from China, indicative of the US administration’s reluctance to introduce measures which might be too seen to shoppers or too disruptive to among the largest US expertise corporations.

Turning from a commerce battle to a tech-centric battle would intensify these stress factors. For example, a blanket ban on main Chinese language sensible cellphone producers would see US expertise excluded from roughly 50% of world annual gross sales in that market.

Huawei has garnered probably the most consideration and motion from the US authorities. No different Chinese language agency concerned in bodily expertise has the identical stature on the worldwide stage, and its 5G ambitions pose untenable safety challenges. This distinctive set of circumstances suggests extrapolating instantly from the US-Huawei relationship to the remainder of the Chinese language tech ecosystem isn’t an applicable base situation, and nearer to a worst case consequence. The rollout of further export controls might introduce extra problems for each US and Chinese language expertise corporations, however are prone to be sufficiently porous within the brief time period reasonably than an inviolable provide chain severance.

The dimensions of the mutually assured harm to each US and Chinese language

corporations that may comply with a “sudden cease” second of tech decoupling

suggests the US authorities will as a substitute proceed to progressively refine the

mechanisms by which it restricts China’s entry to expertise.

Home fortresses

As is the case with main US corporations, a extra expansive definition

than the IT sector is required to seize Chinese language leaders who make

in depth use of expertise or on-line platforms however fall within the

communication providers or client discretionary sectors.

This broader group of Chinese language tech leaders – Tencent, Alibaba, Baidu, Meituan-Dianping, and JD.com – have far more concentrated home publicity than the FANG shares, Microsoft, or Apple within the US, and have a a lot bigger weighting in MSCI China than the standard IT sector. These corporations are vital sources of demand for high-tech merchandise produced all over the world reasonably than a significant a part of world provide chains.

Regardless of their dimension and pervasive attain, Chinese language expertise heavyweights are usually not regularly at odds with the home authorities. The propensity for cooperative, symbiotic relationships between business titans and the state entails that dominant positions are a function, not a bug. Thisrelatively insular place and entry to a major, captive home market might show a stabilizing pressure for China’s largest corporations, as there are fewer regulatory factors of battle and a ruling class whose dedication to macroeconomic stabilization and the success of expertise is resolute.

Beijing has additionally proven an rising willingness to underwrite exercise within the conventional IT sector in a bid for eventual import substitution (Made in China 2025, a state-led industrial coverage that seeks to make China dominant in world high-tech manufacturing), enhancing this structural pattern. Cash is not any panacea in a worst-case situation that features the lack of foundational US applied sciences, however does assist scale back the ramifications of any cyclicality in Chinese language tech and offset the adversarial impacts of restrictive US insurance policies. For example, Huawei was capable of develop revenues at a double digit tempo year-on-year within the first half of 2020 due to its main place within the home smartphone market and demand from state-owned Chinese language enterprises throughout quite a lot of enterprise models.

World Presence, world stakeholders

The flexibility of US tech heavyweights to submit persistently elevated

profitability or add to their commanding world footprints will probably be

challenged by politicians who query points of their enterprise fashions

that present this dominant market place and the way little their tax

burden is proportional to their dimension and success.

A bipartisan consensus of US politicians favors extra scrutiny of home expertise giants, which have come beneath fireplace over low efficient tax charges, tolerance of disinformation, privateness issues and anti-competitive conduct.

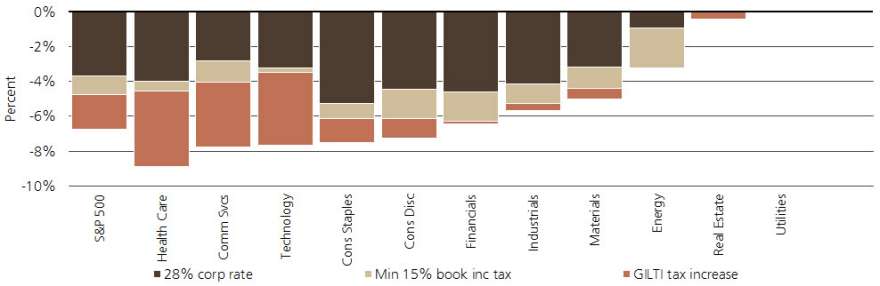

Democrats would possible be extra aggressive and thorough in redressing the perceived societal and financial ills linked to the sector. Present polling and prediction markets counsel that if the November US election have been held at present, the expectation can be for Democratic candidate Joe Biden to prevail, with the Democrats retaining management of the Home of Representatives whereas additionally taking the Senate. Biden’s plan calls for a tax on minimal e book earnings and a better charge levied on earnings related to intangible property shifted to a lower-tax overseas locale. US tech multinationals can be among the many most negatively affected by these measures. International governments are additionally prone to push for taxes as effectively, based mostly on these corporations’ substantial worldwide presences.

Whereas any antitrust campaigns might take years to provide tangible actions, any traction on this subject might trigger traders to query whether or not the longer-term earnings energy of many main corporations can be sustainable beneath present valuations. Conversely, these corporations might show comparatively immune from political breakup pressures beneath the pretense that they’re home champions integral to sustaining US technological superiority.

What’s within the value?

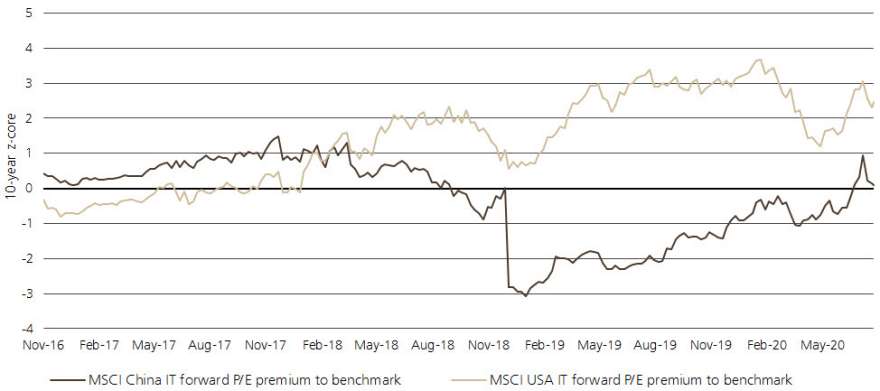

The pandemic has possible accelerated expertise adoption and pulled ahead digitization. This thesis has been embraced far more by traders in US IT shares in comparison with their Chinese language friends, judging by the comparatively muted earnings outperformance vs. the benchmark anticipated for the latter over the subsequent 12 months.

Chinese language IT shares have usually traded at a significant premium to their US rivals on a ahead value to earnings foundation, although this has materially ebbed because the begin of the commerce battle in 2018.

Greater valuations are additionally indicative of the previous cycle’s pattern in earnings development, with Chinese language IT handily outstripping its US counterpart. And in comparison with different Chinese language equities, tech shares aren’t at traditionally stretched ranges, in stark distinction to the setup stateside. The MSCI USA IT index has a a number of that’s two normal deviations above that of the MSCI USA based mostly on the previous decade of observations; the comparable premium for MSCI China IT is just modestly above common. Pure IT is a comparatively restricted a part of the MSCI China Index, however this differential within the relative valuation premium additionally usually holds for among the largest corporations in these markets, like Alibaba and Tencent in China and Amazon and Microsoft within the US.

The US tech sector is the preeminent supply of software program shares globally, which account for one-third of the index and might exhibit defensive traits in periods of financial stress. China’s tech sector is extra bodily oriented, with practically 60% weighted in expertise hardware and gear. Semis account for simply greater than one-fifth of the tech sector in China, and rather less than that stage within the US. This business composition would additionally are likely to work extra in China’s favor on the onset of an early cycle surroundings.

Credit score:Source link

Comments

Post a Comment